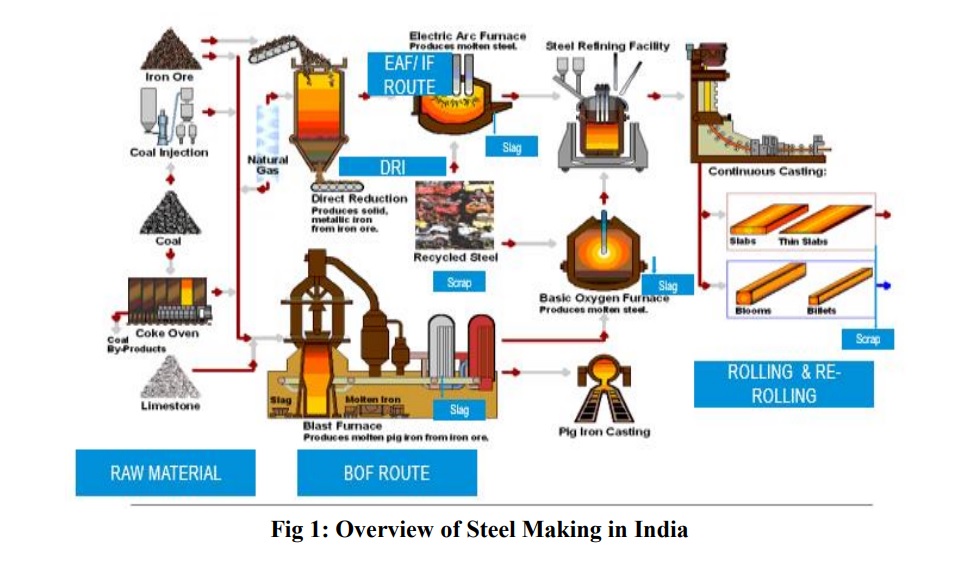

TMT Bars Steelmaking can be classified under two heads, namely, BF-BOF (Blast Furnace – Basic Oxygen Furnace) route and Electric / Induction Furnace route route. BF-BOF route Iron Ore as primary source of raw material where as in EAF/IF route the raw materials are Steel scrap, Sponge Iron and to some extent Pig Iron. The installed capacity and production from different route in 2017-18 in million tons was as follows 4 : Route Installed Capacity, MT Production, MT Iron/ DRI BF 80.556 73.744 DRI 49.617 30.511 Crude Steel BOF 55.267 47.489 EAF 40.242 26.421 IF 42.466 29.221 The production of crude steel from BF-BOF route contributes around 45 % of India’s tmtbars making capacity while the remaining 55 % is processed through the electric route.

India is also the largest producer of sponge iron with the installed capacity of around 49 MT but the utilization is quite low, which is also a feed material for the electric route of steelmaking, in addition to scrap. BF-BOF remains the main route in countries where the required raw materials are available.

Production of high-end flat products (for automotive, Oil & Gas, Lifting & Excavation segments etc.) is more convenient through this route. Historically, as countries have matured, share of EAF has increased, due to environmental concerns. As the demand of steel is increasing continuously in India, it is expected that EAF contribution shall remain in the same ratio but the installed capacity shall increase considerably.

Major Indian Steel Producers Broadly there are two types of producers in India, namely, major steel producers and MSME (secondary/mini) steel producers. Integrated/ major steel plants have facilities to convert iron ore into hot metal and further process the hot metal into steel.

The liquid steel is cast into slabs, billets and blooms and these are further processed into finished products such as hot rolled coil, cold rolled coil, structural, wire rods, rails, bars etc. Currently the major integrated steel players in India include SAIL, Tata Steel, JSW, RINL, JSPL, Shyam Steel, Essar Steel, Bhushan Steel Ltd ( recently taken over by Tata steel)., Bhushan Steel & Power Ltd. etc.

The capacity of each plant of major players is in excess of 1 million and at several location it is having upto 12 million tons at single location. Secondary (MSME) steel producers use scrap or sponge iron/direct reduced iron (DRI) or hot briquetted iron (HBI). This sector comprises mainly electric arc furnaces (EAF) and induction furnaces (IF) units, apart from steel processing units such as hot rolling, cold rolling and rerolling units. Sponge iron and merchant pig iron producers are also included in the secondary (MSME) steel producer category.

There are approximately 313 sponge iron producers, 42EAFs, 1126IFs, and around 1157 small and medium sized steel rerolling mills (SRRMs) scattered over the country.

They are usually found in clusters, with each cluster having about 50-400 units. Collectively, the MSME steel sector produces around 30MT of finished steel, which is close to 34% of India’s steel production. It has been estimated that the sector employs directly and indirectly, around 400,000 people. A general overview of Steel making in India is shown in Figure-1